1189 W 36th Pl - Value-add Investment - 1 Block to USC

This feature is unavailable at the moment.

We apologize, but the feature you are trying to access is currently unavailable. We are aware of this issue and our team is working hard to resolve the matter.

Please check back in a few minutes. We apologize for the inconvenience.

- LoopNet Team

thank you

Your email has been sent!

1189 W 36th Pl - Value-add Investment - 1 Block to USC

4 Unit Apartment Building Offered at $3,975,317 CAD at a 8.80% Cap Rate in Los Angeles, CA 90007

Investment Highlights

- 4 Unit - 16 Bedroom USC Student Housing Apartment Complex

- Opportunity to Implement Renovation Plan by Improving Unit Interiors, Common Areas, and Community Deck.

- Less than 1 Block to the University of Southern California

- Excellent Value-add Investment Opportunity

- Located in the Desirable DPS Patrol Zone

- Gross Income: $24,000/Month

Executive Summary

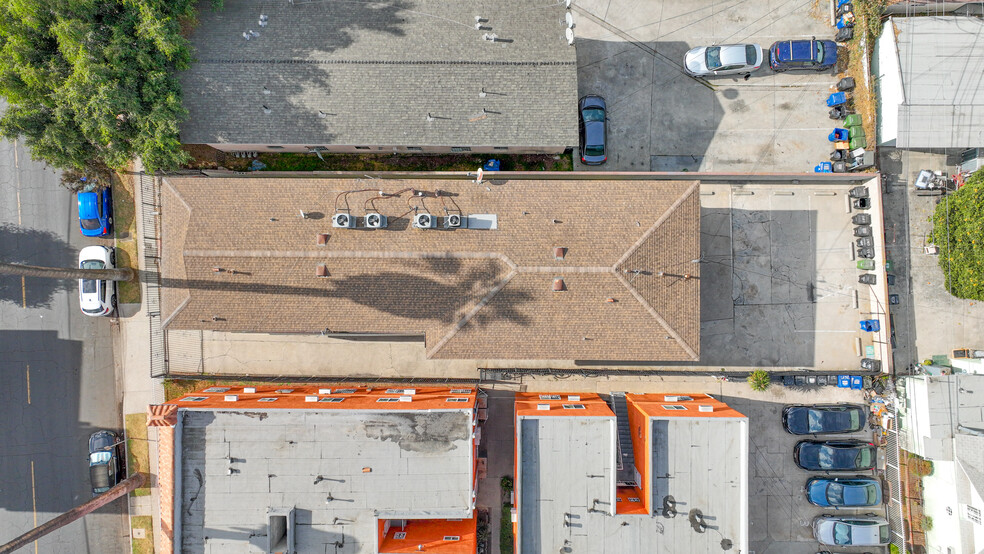

The Davis Saadian Group is pleased to offer the opportunity to acquire this four (4) unit, 16-bedroom, value-add student housing apartment complex, located in the highly desirable DPS Patrol Zone, less than 1 block to the University of Southern California (USC).

This two-story building was constructed of wood frame and stucco on a raised foundation built in 1960 with a square footage of 4,923 on a 5,981-square foot lot. The building has been reinforced and upgraded in compliance with the latest city codes and regulations, and is comprised of a remarkable unit mix, consisting of (4) 4-bedroom + 2-bathroom units. The investment boasts spacious floor plans, secured gated entry, an on-site laundry room for additional income, five (5) on-site parking spaces, and individually metered for gas and electricity. Three of the four units will be delivered vacant upon the close of escrow – an excellent value-add opportunity to remodel and update the units to achieve top market rents.

Combined with parental guarantees on leases and occupancy levels routinely achieving 100% for the school year, the asset represents a low-risk investment that is poised for continued growth and excellent operating fundamentals. The expansive lot size allows an investor to add even more value to the property by constructing an ADU to further increase cash-flow (about $5,500/month), generating an even higher yield/ net income. (Buyer to verify)

PLEASE NOTE THE FOLLOWING:

1) DO NOT DISTURB THE TENANTS.

2) Submit Offer on a CAR Residential-Income Purchase Agreement.

3) Interior Inspection/Books & Records Granted with an Accepted Offer.

4) Submit Proof of Funds & Pre-Qualification Letter with Offer.

5) Seller Selects all Services.

Disclaimer: All information has been secured from sources we believe to be reliable. However, we make no representation or warranties, expressed or implied, as to the accuracy of the information provided, including square footage, lot size, permitted or un-permitted spaces, and/or bedroom/bathroom count. Buyer is advised to independently verify the accuracy of this information through personal inspections and/or with appropriate professionals. Buyer bears all risk for any inaccuracies.

This two-story building was constructed of wood frame and stucco on a raised foundation built in 1960 with a square footage of 4,923 on a 5,981-square foot lot. The building has been reinforced and upgraded in compliance with the latest city codes and regulations, and is comprised of a remarkable unit mix, consisting of (4) 4-bedroom + 2-bathroom units. The investment boasts spacious floor plans, secured gated entry, an on-site laundry room for additional income, five (5) on-site parking spaces, and individually metered for gas and electricity. Three of the four units will be delivered vacant upon the close of escrow – an excellent value-add opportunity to remodel and update the units to achieve top market rents.

Combined with parental guarantees on leases and occupancy levels routinely achieving 100% for the school year, the asset represents a low-risk investment that is poised for continued growth and excellent operating fundamentals. The expansive lot size allows an investor to add even more value to the property by constructing an ADU to further increase cash-flow (about $5,500/month), generating an even higher yield/ net income. (Buyer to verify)

PLEASE NOTE THE FOLLOWING:

1) DO NOT DISTURB THE TENANTS.

2) Submit Offer on a CAR Residential-Income Purchase Agreement.

3) Interior Inspection/Books & Records Granted with an Accepted Offer.

4) Submit Proof of Funds & Pre-Qualification Letter with Offer.

5) Seller Selects all Services.

Disclaimer: All information has been secured from sources we believe to be reliable. However, we make no representation or warranties, expressed or implied, as to the accuracy of the information provided, including square footage, lot size, permitted or un-permitted spaces, and/or bedroom/bathroom count. Buyer is advised to independently verify the accuracy of this information through personal inspections and/or with appropriate professionals. Buyer bears all risk for any inaccuracies.

Financial Summary (Actual - 2023) |

Annual (CAD) | Annual Per SF (CAD) |

|---|---|---|

| Gross Rental Income |

$416,324

|

$84.57

|

| Other Income |

-

|

-

|

| Vacancy Loss |

-

|

-

|

| Effective Gross Income |

$416,324

|

$84.57

|

| Taxes |

-

|

-

|

| Operating Expenses |

-

|

-

|

| Total Expenses |

$66,563

|

$13.52

|

| Net Operating Income |

$349,761

|

$71.05

|

Financial Summary (Actual - 2023)

| Gross Rental Income (CAD) | |

|---|---|

| Annual | $416,324 |

| Annual Per SF | $84.57 |

| Other Income (CAD) | |

|---|---|

| Annual | - |

| Annual Per SF | - |

| Vacancy Loss (CAD) | |

|---|---|

| Annual | - |

| Annual Per SF | - |

| Effective Gross Income (CAD) | |

|---|---|

| Annual | $416,324 |

| Annual Per SF | $84.57 |

| Taxes (CAD) | |

|---|---|

| Annual | - |

| Annual Per SF | - |

| Operating Expenses (CAD) | |

|---|---|

| Annual | - |

| Annual Per SF | - |

| Total Expenses (CAD) | |

|---|---|

| Annual | $66,563 |

| Annual Per SF | $13.52 |

| Net Operating Income (CAD) | |

|---|---|

| Annual | $349,761 |

| Annual Per SF | $71.05 |

Property Facts

| Price | $3,975,317 CAD | No. Units | 4 |

| Price Per Unit | $993,829 CAD | Property Type | Multifamily |

| Sale Type | Investment | Building Size | 4,923 SF |

| Cap Rate | 8.80% | No. Stories | 2 |

| Gross Rent Multiplier | 9.55 | Year Built | 1960 |

| Price | $3,975,317 CAD |

| Price Per Unit | $993,829 CAD |

| Sale Type | Investment |

| Cap Rate | 8.80% |

| Gross Rent Multiplier | 9.55 |

| No. Units | 4 |

| Property Type | Multifamily |

| Building Size | 4,923 SF |

| No. Stories | 2 |

| Year Built | 1960 |

Unit Mix Information

| Description | No. Units | Avg. Rent/Mo | SF |

|---|---|---|---|

| 4+2 | 1 | $8,673 CAD | 1,250 |

| 4+2 | 1 | $8,673 CAD | 1,250 |

| 4+2 | 1 | $8,673 CAD | 1,250 |

| 4+2 | 1 | $8,673 CAD | 1,250 |

1 of 1

Walk Score ®

Very Walkable (83)

Bike Score ®

Very Bikeable (79)

1 of 20

VIDEOS

3D TOUR

PHOTOS

STREET VIEW

STREET

MAP

1 of 1

Presented by

1189 W 36th Pl - Value-add Investment - 1 Block to USC

Already a member? Log In

Hmm, there seems to have been an error sending your message. Please try again.

Thanks! Your message was sent.