103-Unit Portfolio | Chicago Southsides

This feature is unavailable at the moment.

We apologize, but the feature you are trying to access is currently unavailable. We are aware of this issue and our team is working hard to resolve the matter.

Please check back in a few minutes. We apologize for the inconvenience.

- LoopNet Team

thank you

Your email has been sent!

103-Unit Portfolio | Chicago Southsides

7 Properties Offered at $11,574,563 CAD in Chicago, IL

Investment Highlights

- (34) Single Family Homes

- (1) 7-Unit Mixed-Use & (1) 10-Unit Mixed-Use

- Over 90% Occupied

- (12) 2-4 Multi-Units

- +/-55% of Units are Subsidized (Affordable Housing)

- Numerous future exit strategy possibilities

Executive Summary

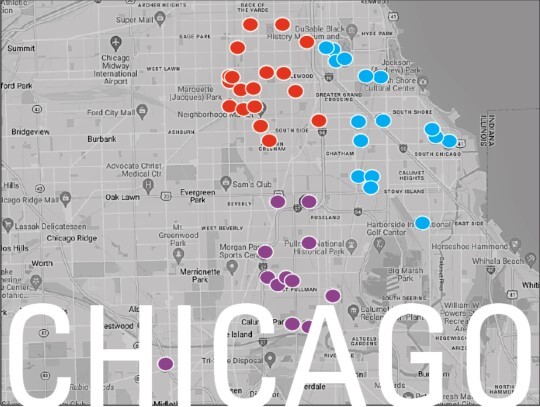

The "Stonysouth Side Portfolio" is a portfolio of 103 units located throughout the south side neighborhoods of Chicago. The portfolio includes 34 Single Family Homes, 64 Apartments/Condos/TH, and 5 commercial spaces spread across twelve 2-4 unit buildings, one 7-unit building, and one 10-unit building. The unit mix options are favorable, with (9) 1 bed 1 bath, (30) 2 bed 1 bath, (32) 3 bed 1-2 baths, (25) 4 bed 1-2 baths, (2) 5 bed 1-2 baths, and 5 commercial spaces with an average of 1200 sf.

The single-family homes are broken down as follows: (6) 2 bed 1 bath with an average of 1,000 sf, (8) 3 bed 1 bath with an average of 1,100 sf, (1) 3 bed 1.5 bath at 1100 sf, (1) 3 bed 2 bath at 1100 sf, (10) 4 bed 1 bath with an average of 1,500 sf, (7) 4 bed 2 bath at an average of 1,400 sf, and (1) 5 bed 1 bath at 2,000 sf. Approximately 55% of the units are rented to various subsidized programs, including CHA, HACC, Heartland, and Catholic Charities.

The portfolio presents a qualified investor with the opportunity to achieve immediate success, with a CAP Rate of 8.39% and a Total Return in year 1 up to 9.80% based on a 70% LTV and 6.75% Interest Rate. The exit strategy would be to improve the single-family homes and the 2-4 unit multi-unit properties and sell them individually, as the market has seen a high demand for FHA buyers seeking to buy their first home or first investment property. A qualified buyer has the option to assume the current loan in place. The loan has a 5.11% Interest Rate, a ten-year loan term expiring in 2029, and a thirty-year amortization period. The approximate loan balance is $6,500,000.

The single-family homes are broken down as follows: (6) 2 bed 1 bath with an average of 1,000 sf, (8) 3 bed 1 bath with an average of 1,100 sf, (1) 3 bed 1.5 bath at 1100 sf, (1) 3 bed 2 bath at 1100 sf, (10) 4 bed 1 bath with an average of 1,500 sf, (7) 4 bed 2 bath at an average of 1,400 sf, and (1) 5 bed 1 bath at 2,000 sf. Approximately 55% of the units are rented to various subsidized programs, including CHA, HACC, Heartland, and Catholic Charities.

The portfolio presents a qualified investor with the opportunity to achieve immediate success, with a CAP Rate of 8.39% and a Total Return in year 1 up to 9.80% based on a 70% LTV and 6.75% Interest Rate. The exit strategy would be to improve the single-family homes and the 2-4 unit multi-unit properties and sell them individually, as the market has seen a high demand for FHA buyers seeking to buy their first home or first investment property. A qualified buyer has the option to assume the current loan in place. The loan has a 5.11% Interest Rate, a ten-year loan term expiring in 2029, and a thirty-year amortization period. The approximate loan balance is $6,500,000.

Property Facts

| Price | $11,574,563 CAD | Number of Properties | 6 |

| Price / SF | $395.01 CAD / SF | Individually For Sale | 0 |

| Cap Rate | 8.39% | Total Building Size | 29,302 SF |

| Sale Type | Investment | Total Land Area | 0.41 AC |

| Status | Active |

| Price | $11,574,563 CAD |

| Price / SF | $395.01 CAD / SF |

| Cap Rate | 8.39% |

| Sale Type | Investment |

| Status | Active |

| Number of Properties | 6 |

| Individually For Sale | 0 |

| Total Building Size | 29,302 SF |

| Total Land Area | 0.41 AC |

Properties

| Property Name / Address | Property Type | Size | Year Built | Individual Price |

|---|---|---|---|---|

| 1426 E 66th Pl, Chicago, IL 60637 | Multifamily | 2,800 SF | 1913 | - |

| 7734 S Ashland Ave, Chicago, IL 60620 | Multifamily | 10,674 SF | 1927 | - |

| 647-651 W 69th St, Chicago, IL 60621 | Retail | 7,656 SF | 1888 | - |

| 1408 E Marquette Rd, Chicago, IL 60637 | Multifamily | 4,200 SF | 1924 | - |

| 5825 S Michigan Ave, Chicago, IL 60637 | Multifamily | 10,000 SF | 1970 | - |

| 6137 S King Dr, Chicago, IL 60637 | Multifamily | 3,075 SF | 1935 | - |

| 11420 S Eggleston Ave, Chicago, IL 60628 | Multifamily | 1,571 SF | 1945 | - |

1 of 1

1 of 3

VIDEOS

3D TOUR

PHOTOS

STREET VIEW

STREET

MAP

1 of 1

Presented by

103-Unit Portfolio | Chicago Southsides

Already a member? Log In

Hmm, there seems to have been an error sending your message. Please try again.

Thanks! Your message was sent.